Let’s be honest: the era of “cheap traffic” didn’t just end; it went out in a blaze of glory, taking most of our ROAS targets with it. If you’ve spent the last few quarters watching your Customer Acquisition Cost (CAC) climb like an elite mountaineer while your paid media returns hit a frustrating plateau, you aren’t alone—you’re just experiencing the “rented growth” hangover. For years, the e-commerce playbook was a simple, expensive loop: buy traffic, get a sale, and pray they come back. But in a world of privacy updates and bidding wars, renting your audience from Big Tech has become a recipe for razor-thin margins and high-stress Mondays.

This is exactly why the conversation in the boardroom has shifted from “How do we get more people to the site?” to the much more existential reality of CAC vs LTV in e-commerce. Real, sustainable growth isn’t about the next flashy campaign; it’s about Customer Lifetime Value (CLTV)—the ultimate metric that determines whether you’re actually building a brand or just subsidizing a billionaire’s next social media experiment.

If you want to scale today, you have to stop treating your customers like a series of expensive one-night stands and start focusing on long-term revenue ownership. We’re moving beyond the “one-and-done” ghosting phase because:

- Rent is rising: You’re paying more to “rent” the same audience from ad platforms every single month, only for the algorithm to change the rules mid-game.

- The Web is Leaky: Mobile web browsers are built for searching and bouncing, not for staying—this creates a massive, invisible CLTV gap that most brands simply ignore.

- Ownership is the Alpha: In the current market, scaling is no longer about who has the biggest ad budget; it’s about who has the strongest “owned” connection to their buyers.

It’s time to stop renting your best customers and start building the system that turns them into brand devotees. The real revenue question isn’t how to find more people, but how to actually keep the ones you’ve already paid for.

Mobile Traffic Is Growing, So Why Isn’t Revenue Scaling With It?

It’s the ultimate paradox of modern e-commerce. You check your Shopify or GA4 dashboard, and the numbers look like a success story: mobile traffic is up, your social ads are stopping the scroll, and your “Mobile-First” design looks beautiful on a MacBook Pro.

Yet, when you look at the revenue scaling relative to that traffic, something is broken. The “Mobile Web” traffic is pouring in, but the bank account isn’t filling up at the same rate.

If you’re a Founder or CMO, the instinct is to point fingers. Is the creative getting stale? Is the media buying team missing the mark? Is the “Add to Cart” button the wrong shade of blue? Usually, the answer is none of the above. The problem isn’t your team’s execution—it’s a structural ceiling inherent to the mobile web itself.

The Invisible "Friction Tax" of Mobile Browsers

We’ve been conditioned to think that a “mobile-responsive” site is enough. But there is a massive difference between a site that fits on a phone and an experience that is built for one. Mobile web browsers (Chrome, Safari) were designed for discovery and research, not for high-velocity, high-frequency shopping.

Even with the best tools in the world, your mobile web store is fighting an uphill battle against three systemic blind spots:

- The Latency Trap: Industry data shows that even a 0.1-second delay in mobile site speed can drop conversion rates by over 8%. Every time a customer has to wait for a mobile web page to re-render, you’re paying a “Latency Tax” that bleeds your ROAS dry.

- The Checkout Chasm: Mobile web cart abandonment hit a staggering 83.6% recently. Why? Because asking a customer to manually type their credit card and shipping info into a mobile browser is like asking them to fill out a tax return while standing in line for coffee.

- The Session Disconnect: Mobile web users are “transient.” They arrive via a link, browse in a tab, and then… they’re gone. Without native persistence, you’re forced to spend more on retargeting ads just to remind them you exist.

Why "More Traffic" Won't Fix a Leaky Bucket

For many brands, the reaction to plateauing revenue is to increase the ad budget. But if your mobile e-commerce conversion issues are structural, more traffic just means more waste. You’re essentially pouring high-octane fuel into an engine with a clogged exhaust.

From a business perspective, the benefit of moving beyond the mobile web isn’t just “better UX”—it’s about revenue security. > Systemic Insight: When you rely solely on the mobile web, you don’t own your customer journey; you’re borrowing it from the browser and the ad platforms.

By understanding that the mobile web has a natural “conversion ceiling,” you can stop blaming your marketing strategy and start addressing the digital transformation needed to capture the 70% of shoppers who are already in your ecosystem but are simply too frustrated to check out.

The Hidden CLTV Gap Between Mobile Web and Mobile Apps

Let’s talk about the “Growth Ceiling.” You’ve done everything right—your mobile web experience is sleek, your checkout is “optimized,” and yet, your Customer Lifetime Value (CLTV) feels like it’s stuck in second gear.

The problem isn’t your marketing; it’s the structural limitations of the mobile web. Think of it this way: The mobile web is a high-traffic highway where people stop for a quick “search and buy” before speeding off. An app, however, is your customer’s favorite local hangout. One is built for discovery; the other is built for devotion. When we talk about mobile app ROI in e-commerce, we aren’t just talking about a few extra sales—we’re talking about a fundamental shift in how revenue compounds over time.

Why Execution Fails Despite Modern Tools

You might be using the best headless commerce stacks or the shiniest web plugins, but you’re still fighting a systemic blind spot: Browser amnesia. Every time a customer closes their mobile tab, they effectively “forget” you. To get them back, you have to pay the “Retargeting Tax” (again).

This creates a massive CLTV Gap. While mobile web is great for that first date (acquisition), it’s terrible at keeping the marriage alive. Apps bridge this gap by staying on the home screen, remembering preferences without a login, and using native features to turn a one-time buyer into a serial shopper.

The Face-Off: Mobile Web vs. Mobile App

If we look at the data for 2026, the delta between a “responsive site” and a “native app” isn’t just a slight edge—it’s a canyon.

| Metric | Mobile Web (Discovery) | Mobile App (Loyalty) | The “Why” |

| Conversion rate | ~1.8% – 2.1% | 3x Higher (5% – 7%) | Frictionless 1-tap checkouts vs. clumsy form-filling. |

| Retention (30 day) | Low (< 10%) | 190% Higher | Push notifications & home screen presence vs. “lost tabs.” |

| Average order value | Baseline | +10% to 30% | Personalized feeds and “swipe-to-buy” ease. |

| Repeat purchases | Transactional | 2x Frequency | Always-on access and native loyalty integration. |

| Time spent/month | ~11 Minutes | 200+ Minutes | Apps are immersive; the web is a utility. |

Implementing the Trend at the Right Time

From a business perspective, the benefit of an app isn’t just “having an app”—it’s about securing your future revenue. If your brand has reached a point where 70% of your traffic is mobile, but your retention rates are plateauing, you’ve hit the Web Ceiling. Building an app at this stage isn’t a “nice-to-have” digital transformation; it’s a strategic move to stop the leak in your bucket.

The Systemic Truth: Mobile web attracts, but mobile apps compound. If you’re still treating the two as “the same thing but smaller,” you’re missing the single biggest lever for 2026 growth.

The question for leadership isn’t just about building costs; it’s about the cost of not owning that direct line to your best customers. When you move high-intent users from the web into an app, you aren’t just changing the UI—you’re changing the math of your entire business.

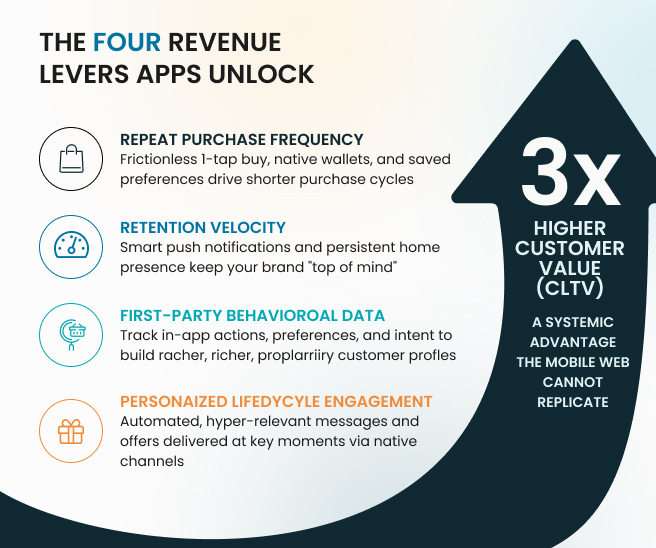

The Four Revenue Levers Apps Unlock That Web Cannot

We’ve established that apps aren’t just “nicer websites”; they’re fundamentally different beasts when it comes to long-term value. Now, let’s peel back the layers and get specific. How exactly do apps deliver that jaw-dropping 3x higher CLTV? It’s not magic; it’s a strategic advantage unlocked by four distinct revenue levers that the mobile web simply can’t pull.

These aren’t just features; they’re systemic advantages that create a compounding effect on your revenue. Think of them as the hidden gears in the machine of sustainable e-commerce growth.

Here’s a visual representation of these powerful levers in action:

Now, let’s break down each one, because understanding these is key to implementing a killer app-based retention strategy and truly increasing customer lifetime value in e-commerce.

1. Repeat Purchase Frequency: The "One-Tap" Advantage

Remember that “Checkout Chasm” we talked about on the mobile web? Apps obliterate it. With native wallets (Apple Pay, Google Pay), stored preferences, and persistent login, repeat purchases become a one-tap affair.

No re-entering shipping details, no forgotten passwords, no CAPTCHA. This isn’t just convenience; it’s a reduction in purchase friction that shortens the buying cycle and dramatically increases how often customers come back. You’re not just selling; you’re enabling habitual buying.

2. Retention Velocity: Always On, Always Relevant

Your app lives on the customer’s home screen. It’s not a tab they accidentally close or a bookmark they forget. This persistent presence, combined with smart push notifications, creates “Retention Velocity.” You can re-engage customers with hyper-relevant alerts (back-in-stock, price drop, new arrivals) instantly, without fighting email spam filters or relying on expensive retargeting ads. This keeps your brand “top of mind” and pulls customers back into the buying flow more frequently and effectively than any browser-based channel.

3. First-Party Behavioral Data: The True Goldmine

The mobile web gives you analytics; an app gives you a microscope into customer intent. Apps allow you to collect incredibly rich first-party behavioral data—not just what pages they visited, but how they interact with features, what categories they browse most, their favorite colors, wish-list additions, and even how they navigate through your product catalog. This proprietary data is privacy-compliant, incredibly accurate, and empowers you to build richer, deeper customer profiles that are impossible to replicate with anonymous web traffic. It’s the secret sauce for hyper-personalization.

4. Personalized Lifecycle Engagement: Nurturing, Not Nudging

Armed with that rich behavioral data, apps unlock truly personalized lifecycle engagement. Instead of generic “We miss you!” emails, you can send automated, hyper-relevant messages and offers delivered directly to the user’s device at key moments. Think: a push notification for a discount on exactly the item they just wish-listed, or an in-app message celebrating their loyalty tier with a special early-access perk. This isn’t just marketing; it’s smart, contextual relationship building that makes customers feel seen and valued, driving deeper loyalty and higher CLTV.

These four levers combine to create an experience that transforms a transactional shopper into a loyal brand advocate. The mobile web tries, but it simply lacks the native architecture to deliver on these at scale.

Why Owned Channels Outperform Paid Channels Over Time

If you’re a CMO or CFO, you’ve likely spent the last few years playing an expensive game of “Whack-A-Mole” with your budget. Every time a major platform updates its privacy settings or tweaks its algorithm, your customer acquisition cost (CAC) takes a hike, and you’re left footing the bill just to maintain the status quo.

It’s the classic owned channels vs paid media debate, but with a modern, high-stakes twist. Relying solely on paid acquisition is like building a house on a rented lot where the landlord can double the rent—or evict you—whenever they feel like it. Apps, however, represent “Owned Land.” When you move a customer into your app, you stop paying a “middleman tax” to reach them.

Breaking the Discounting Cycle

Most brands fall into the trap of using heavy discounts as their only retention tool. Why? Because when you’re fighting for attention in a crowded email inbox or a noisy social feed, a “20% OFF” banner is the only way to get a click.

Apps change the math. By leveraging push notifications vs email revenue dynamics, you’ll find that push has a 90%+ open rate compared to email’s dwindling 20%. Because the channel is direct and “clutter-free,” you can drive sales through exclusivity, early access, and personalization rather than just slashing your margins. You’re not just saving on ad spend; you’re protecting your brand equity.

The Financial Reality: Paid vs. Owned

Let’s look at how these two worlds actually stack up when you’re trying to scale a sustainable e-commerce business.

| Feature | Paid Media | Owned App Channels ( The Equity) |

| Cost per re-engagement | $0.50 – $2.00+ per click | $0.00 (Unlimited Push) |

| Algorithm risk | High (One update can kill ROI) | Zero (You own the pipe) |

| Visibility | Buried in feeds/inboxes | Persistent (Home screen icon) |

| Conversion driver | Discounts & Promos | Convenience & Community |

| Data quality | “Walled Garden” (Aggregated) | First-Party (Granular & Clean) |

What the Data Shows: App Users vs Mobile Web Users

If you’re still on the fence about whether an app is a “luxury” or a “necessity,” it’s time to look at the cold, hard math. We’re moving past the hype and into the observable behavior patterns of 2026.

The data tells a consistent story: Mobile web is excellent for the “handshake”—that initial discovery and first-time purchase. But when it comes to building an actual revenue engine, the app is where the heavy lifting happens. App users aren’t just “slightly better” customers; they operate on an entirely different plane of engagement.

The Behavioral Divide: Engagement & Retention

Recent mobile app retention benchmarks for the e-commerce sector reveal a stark contrast. While a mobile web user is often a “transient” visitor who arrives via a search link and disappears once the tab is closed, an app user has made a conscious “home screen commitment.”

| Metric | Mobile Web (The “Visitor”) | Mobile App (The “Devotee”) | The Data-Driven “Why” |

| Conversion rate | ~1.8% | ~5.1% (3x higher) | Frictionless, native checkout & 1-tap payments. |

| Product viewed | 1.0x (Baseline) | 4.2x More Products | Native UI allows for high-speed, “lean-back” browsing. |

| Cart abandonment | ~85% | ~20% | Apps eliminate the “form-filling” fatigue of browsers. |

| 30-day retention | < 2% | 15% – 25% | Persistent presence + smart push notifications. |

| Average order value | $80 – $90 | $110 – $130 | Deep personalization drives “frequent small wins.” |

Global Patterns: Where the App Revolution is Winning

When an E-commerce App Makes Sense And When It Doesn’t

While the trend toward mobile apps is clear, the real story lies in where that shift has already become decisive. Geography reveals why an e-commerce app delivers outsized returns in some markets while adding limited value in others.

The map below illustrates a world divided between regions still operating within the mobile web’s constraints and those where a native-first approach has already broken through those limits. This is not simply a visualization of traffic distribution; it’s a signal of market readiness.

In markets where app adoption and engagement are most concentrated, consumers don’t just prefer apps — they expect them. Higher install rates, repeat usage, and dramatically longer time-spent sessions form the baseline. For global brands, overlooking these regions means ignoring territories where owned channels drive compounding growth. In contrast, in markets where browser-led behavior still dominates, a mobile app may introduce operational complexity without delivering proportional return.

Why the Gap Exists (The Systemic View)

This isn’t just about a “better UI.” It’s about performance stability. Mobile websites are at the mercy of browser engines, varying internet speeds, and “tab clutter.” Native apps, however, use local device storage to pre-load content, making them 2-3x faster than the mobile web.

The Reality Check: In 2026, “patience” is a relic of the past. A 1-second delay in page load on the mobile web can cost you 7% in conversions. Apps don’t just fix the speed—they fix the relationship.

By grounding your strategy in these retention benchmarks, you move away from “hoping” for growth and start engineering it. The data shows that while the web brings the crowd, the app keeps the revenue.

From Tools to Systems: Why Apps Work Only When Connected to Execution

Here is a hard truth that most “app-builder” platforms won’t tell you: an app is not a magic wand. If you treat an app as a standalone “tool” to be checked off a list, it will likely end up as an expensive icon gathering digital dust on your customers’ screens.

The e-commerce landscape is littered with brands that underwent a “digital transformation” only to find that their shiny new app didn’t move the needle. This is the execution failure trap. The problem isn’t the technology; it’s the lack of a systemic approach. An app is simply a high-performance engine—if you don’t connect it to the rest of the car, you aren’t going anywhere.

The Difference Between a Tool and a System

In a typical digital transformation in e-commerce, brands buy tools to solve isolated problems. They buy an SMS tool for alerts, an email tool for newsletters, and an app for “loyalty.” But these tools often live in silos, speaking different languages and chasing different KPIs.

A true e-commerce retention system, however, integrates the app into the very fabric of your business operations.

- Data Symmetry: Your app shouldn’t just track clicks; it should feed your warehouse, your customer support, and your product development teams with real-time intent data.

- Omnichannel Harmony: If a customer abandons a cart on the web, the app should know. If they buy in-store, the app should reward them. The system ensures the brand experience is a single, continuous conversation.

- Automated Execution: High-growth brands don’t manually send “We miss you” pushes. They build triggers based on behavioral thresholds—predicting a churn before it happens because the system recognizes the patterns.

Why the Problem Persists Despite Modern Tools

The reason many brands fail to see a 3x CLTV lift is that they apply “web thinking” to an “app world.” They use the app to blast generic promotions instead of using it to facilitate a better user experience.

When you move from tools to systems, you stop asking, “How do we get people to download the app?” and start asking, “How does the app make our entire business more efficient?” The benefit from a business perspective is clear: a connected system reduces the manual labor of your marketing team while increasing the precision of your outreach.

It turns your app from a cost center into a self-optimizing revenue generator. You aren’t just implementing a trend; you’re building an infrastructure that scales without needing a linear increase in headcount or ad spend.

An app is the interface, but the system behind it is the strategy. Without the latter, the former is just pixels.

The Real Revenue Question Leaders Should Be Asking

Most leaders are asking, “Should we build an app?”—but in 2026, that’s like asking a pilot if they should use a navigation system. The question is too small. If you want to scale e-commerce revenue sustainably, the real question you need to be asking is: “Do we actually own our growth system, or are we just high-volume tenants on someone else’s platform?”

A true long-term e-commerce growth strategy isn’t built on the whims of an algorithm or the mercy of a third-party browser; it’s built on direct access, proprietary data, and the ability to trigger revenue at will without paying a “discovery tax” every time your customer wants to buy. It’s time to stop wondering if an app is a “feature” you need and start deciding if you’re ready to stop renting your success and start owning your infrastructure.

Conclusion

By now, the pattern is clear. Apps do not create value on their own. They reveal value only when they are connected to a system that prioritizes ownership, retention, and execution discipline.

The brands seeing 3x higher Customer Lifetime Value are not winning because they launched an app earlier or shipped more features. They are winning because they stopped treating growth as a series of campaigns and started treating it as infrastructure. In these organizations, the app is not a channel. It is the interface to a larger operating system that connects data, behavior, retention, and revenue into one continuous loop.

This is where many initiatives quietly fail. Leadership invests in tools, teams ship features, dashboards look impressive, yet execution remains fragmented. Without a connected system behind it, even a well-built app becomes just another surface layer rather than a compounding asset.

Sustainable revenue growth in 2026 will belong to organizations that design for ownership from the start. Owned data. Owned engagement. Owned execution paths. Achieving that requires more than development capability. It requires a partner who understands how apps, data, and execution systems must work together to fundamentally change the economics of growth.

This is the philosophy behind how ZealousWeb approaches e-commerce transformation. Not as an app builder or a feature vendor, but as an operating system partner that connects mobile apps to execution systems, intelligence systems, and long-term revenue ownership.

The question is no longer whether apps drive higher CLTV. The data already answers that. The real question is whether your organization is ready to stop renting outcomes and start operating a system that compounds them.

Looking for a Top-tier Custom E-commerce App?

Explore Our Services

FAQs

Do e-commerce apps really drive higher CLTV, or is this overhyped?

Yes, when implemented as part of a system. Apps increase CLTV by reducing repeat-purchase friction, enabling owned re-engagement, and capturing first-party behavioral data. Without execution systems behind them, apps underperform.

We already have an app. Why hasn’t CLTV improved?

Most apps fail because they operate in isolation. If app behavior does not trigger automated retention, personalization, and lifecycle execution, CLTV remains flat. At ZealousWeb, we focus on connecting the app to execution and data systems.

Can mobile web optimization replace the need for an app?

No. Mobile web is effective for discovery but has a structural retention ceiling. Apps enable persistence, speed, and owned engagement that browsers cannot replicate at scale.

When does building an e-commerce app make business sense?

When mobile traffic dominates but retention and repeat revenue plateau. At that point, an app becomes a revenue ownership strategy, not a UX upgrade.

How long before we see revenue or CLTV impact?

Most brands see early retention and repeat-purchase signals within 6–8 weeks post-launch. Meaningful CLTV lift usually appears within one to two quarters when systems are connected from day one.

Is app development a marketing decision or a tech decision?

Neither. It is an execution decision. Apps deliver value only when aligned with data, retention logic, and cross-team workflows. That is where ZealousWeb focuses its approach.

What does an e-commerce app typically cost?

Costs vary by scope, but serious e-commerce apps usually range between mid to high five figures. Lower-cost builds often exclude system integration, which limits long-term ROI.